Selling property in the Philippines can feel overwhelming, especially if you’re doing it for the first time. I’ve been there. A few years back, I helped my aunt sell her old townhouse in Quezon City. She had no clue where to start. The papers, the fees, the endless viewings—it was all too much.

But here’s the thing: it doesn’t have to be that stressful. Once you get the hang of how it works here, selling property can actually be pretty straightforward. And yes, it can even be a little exciting.

In this post, I’ll walk you through how to make the whole thing easier—from listing to closing. You’ll get practical advice, real-life stories, and those little tips no one tells you until it’s too late.

- Why People Sell Property (And Why It Matters)

- Selling Property in the Philippines: Real Talk from Reddit Users

- First Step: Paperwork (Don’t Skip This)

- Pricing: Don’t Just Guess

- To Broker or Not to Broker?

- Online Listings: First Impressions Matter

- Dealing With Inquiries

- The Offer and Negotiation Phase

- Closing the Sale: Final Steps

- What If You’re Selling From Abroad?

- Common Mistakes to Avoid

- Selling Property in the Philippines: What You Need Before You List

- Final Thoughts

Why People Sell Property (And Why It Matters)

Let’s start with something real—people sell land in the Philippines for all sorts of reasons. Some are relocating abroad. Others inherited land or a house they have no use for. Many are upgrading to a bigger space, while some are simply ready to downsize. Whatever the reason, your goal for selling will shape how you handle the entire process.

Why does your reason matter? Because your goal affects your timeline, your asking price, and even the kind of buyer you want.

My neighbor, for example, sold her condo in Taguig because she was moving to Australia. She didn’t have the luxury of time. So she priced it a bit below market value, sold it in less than a month, and left stress-free.

Meanwhile, another friend sold her ancestral home in Iloilo, but took almost a year. She was emotionally attached and wanted the right buyer—someone who’d care for the house. And that’s okay too.

Your reason sets the tone for your whole approach. Be honest about it from the beginning.

Selling Property in the Philippines: Real Talk from Reddit Users

Sometimes, the best advice doesn’t come from a manual—it comes from people who’ve lived through it. I stumbled across this Reddit thread where someone asked about their experience selling property in the Philippines, and the replies? Surprisingly real and super helpful.

One commenter shared how their family struggled with incomplete documents and ended up delaying the sale by nearly a year. Another mentioned how hiring a licensed broker saved them a ton of stress, especially when it came to handling buyers who were “interested but not really.”

Reading through these kinds of threads gives you a clearer picture of what to expect—beyond the usual textbook answers. If you’re unsure where to start or just want to know what others went through, that Reddit thread is worth checking out.

First Step: Paperwork (Don’t Skip This)

Okay, I won’t lie—this part’s not fun. But it’s crucial. Before you even think of listing your place, make sure your papers are in order.

Here’s a quick checklist:

- TCT or CCT (Title)

- Tax Declaration

- Latest Real Property Tax receipts

- Certificate Authorizing Registration (CAR) if it’s inherited

- Valid IDs of the owner/s

- Deed of Sale (for the final step)

If the title’s not in your name yet (say it was inherited), that’s a separate process. You’ll need to go through esttate settlement first. That can take time, especially if there are multiple heirs. My cousin’s family went through this—took them a year just to transfer the title. They regretted not starting the paperwork earlier.

So here’s my advice: even if you’re just thinking of selling, start checking the documents now. It’ll save you a headache later.

Pricing: Don’t Just Guess

Let’s talk money.

How much should you sell for? Most people start by checking property websites and comparing prices. That’s a good first step—but don’t stop there.

Ask around. Talk to a licensed real estate broker. They know the going rates in your area. You can also request a property appraisal. Some banks and real estate offices offer it for a small fee—or sometimes free if you’re using their services.

Here’s a little story. My uncle had a house in Las Piñas. He listed it at ₱12 million because a neighbor said that’s what homes were going for. But it sat there for 8 months with barely any interest.

Finally, a broker stepped in. Turns out, the right price was around ₱10.8 million. The listing was adjusted and sold within two months.

Lesson? Overpricing wastes time. Underpricing leaves money on the table. Find that sweet spot.

To Broker or Not to Broker?

This one’s tricky. Some folks want to sell on their own to avoid paying commission. That’s understandable. But let me share both sides.

Selling Without a Broker

- You have full control.

- You save on fees (usually 3–5% of selling price).

- But you do everything yourself—marketing, scheduling viewings, handling calls, negotiations, paperwork.

If you have time, energy, and some real estate know-how, it can work. My sister sold her townhouse on Facebook Marketplace. She answered hundreds of messages but got a deal in 6 weeks.

Selling With a Broker

- They handle the heavy lifting.

- They usually have a pool of ready buyers.

- They guide you through the process—especially the legal stuff.

Make sure they’re licensed. Ask for their PRC number. It protects you from scammers.

Personally, I recommend working with a broker if you’re busy or selling from abroad. A good one is worth the commission.

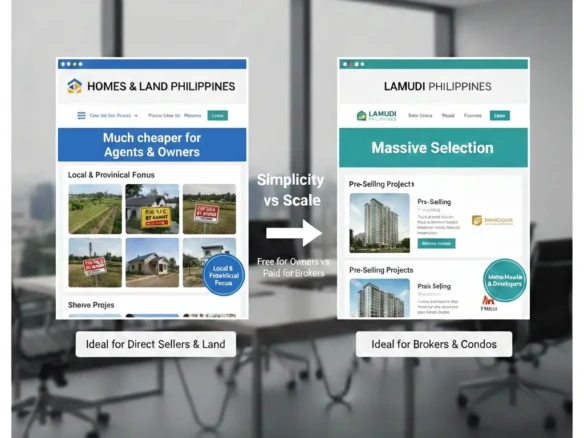

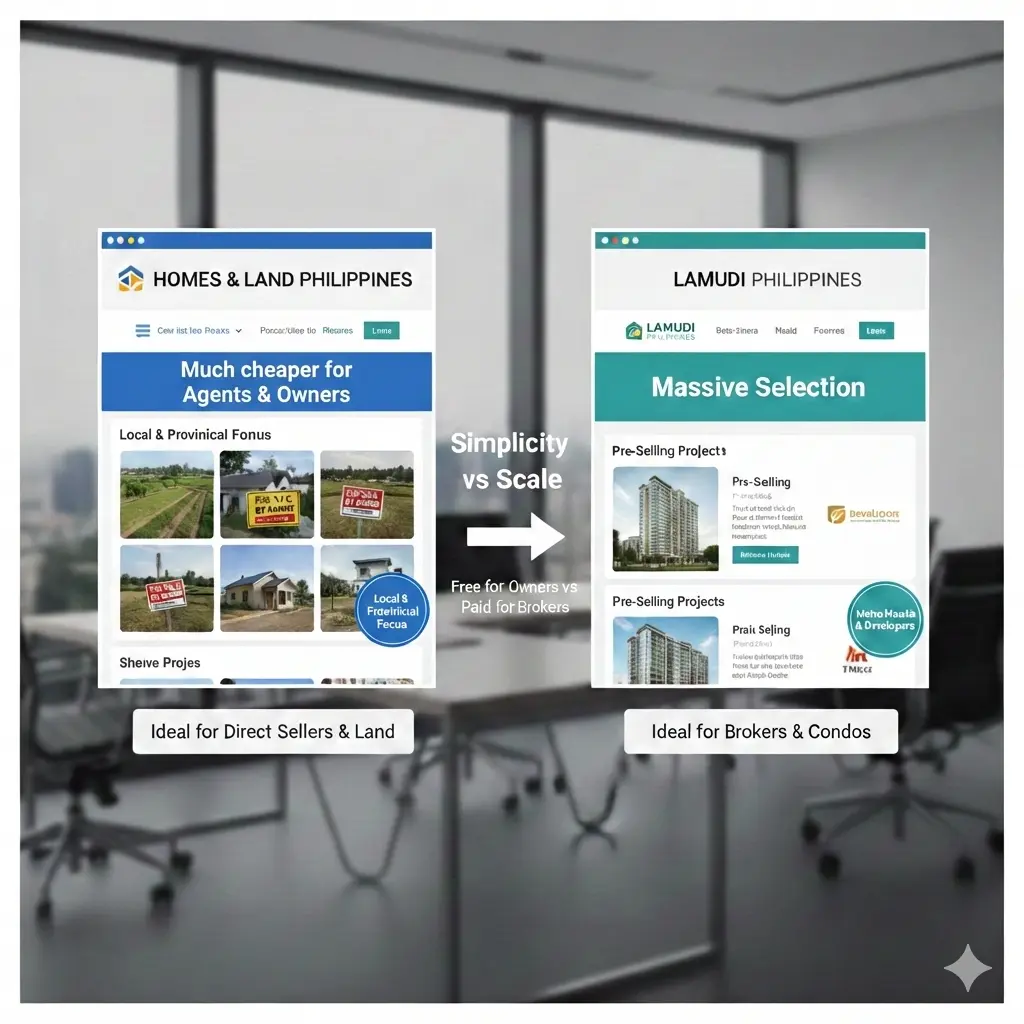

Online Listings: First Impressions Matter

Most buyers in the Philippines start online. Sites like Lamudi, Carousell, and Facebook Marketplace are the usual go-tos. So your ad needs to shine.

Here’s what works:

- Clear, honest photos – Clean the place up first. Natural light helps.

- Detailed but simple description – Lot size, floor area, number of rooms, key features, nearby landmarks.

- Location accuracy – Don’t say “near Ayala” if it’s 45 minutes away.

- Price – Some skip this, thinking it’ll attract curious buyers. But most people scroll past listings without prices.

Bonus tip: include what makes your place unique. Is there a mango tree in the backyard? Did you install solar panels? Say it.

Buyers remember little things. That’s what sticks.

And according to richestph, many Filipino buyers today are more cautious and do their homework online before even messaging a seller. That’s why clear, honest ads matter now more than ever. If your listing feels incomplete or vague, it’s likely to get skipped. Think of your post as your property’s first impresion—it has to be good.

Dealing With Inquiries

Once your listing is live, expect calls, texts, and messages. Some are serious. Others are just curious. A few are—let’s be real—time-wasters.

Set boundaries. Reply politely, but don’t feel bad saying no.

One seller I knew used this line:

“Hi! The house is still available. Feel free to drop by this Saturday for a viewing. We’re doing open house hours from 2–5 PM.”

This saved her from endless back-and-forths. Try grouping viewings if you can.

Also, always meet in safe, public settings if you’re selling on your own. If someone insists on meeting at night, cancel. Safety first.

The Offer and Negotiation Phase

Eventually, someone will make an offer. And here’s where it gets interesting.

Be ready to negotiate. Most buyers will ask for a discount. Decide early on what your lowest acceptable price is. Write it down if you have to.

If you’re working with a broker, they’ll handle this part. If not, stay firm but respectful. Don’t be afraid to walk away from lowball offers.

One seller I spoke to was offered ₱6 million for a property she listed at ₱7.2 million. She said no, and it sold for ₱7.1 million two months later. That’s over a million pesos difference—just for being patient.

Closing the Sale: Final Steps

Once you’ve agreed on a price, things move fast.

The buyer usually gives an earnest money deposit. Then, the formal Deed of Sale is signed. You’ll also need to settle the capital gains tax and documentary stamp tax (usually shouldered by the seller unless agreed otherwise).

Here’s a quick cost breakdown (as of this writing):

- Capital Gains Tax: 6% of selling price

- Documentary Stamp Tax: 1.5%

- Notarial Fees: Depends on sale price

- Transfer Fees and Registration: Paid by the buyer (in most cases)

Make sure payments are done through traceable methods—bank deposits, manager’s checks, etc.

After that, you’ll help the buyer process the title transfer. Most of the legwork falls on their side, but you may still need to sign some documents.

And then… you’re done.

What If You’re Selling From Abroad?

This comes up a lot—selling property while you’re living abroad. It’s actually pretty common, especially for Filipinos working overseas. If you’re in that situation, don’t stress. The key is to grant a Special Power of Attorney (SPA) to someone you trust here in the Philippines. If you’re signing it abroad, just make sure it’s consularized at the nearest Philippine embassy or consulate.

A good friend of mine recently went through this. She was selling property her parents left behind, all while based in Dubai. She had her SPA signed and sent over, and her cousin handled everything—from viewings to dealing with the paperwork. It took a bit more time than usual, but everything went through without major issues.

The process isn’t perfect, but with the right person helping out on the ground, selling property from overseas is totally doable.

Common Mistakes to Avoid

Let’s wrap this up with a few classic blunders to steer clear of:

- Listing without checking documents – You can’t sell what you don’t legally own.

- Overpricing – It just makes buyers scroll past.

- Poor photos or vague ads – They won’t bother messaging you.

- Dealing with unlicensed brokers – Always ask for credentials.

- Not disclosing issues – Buyers appreciate honesty. That leak? Mention it.

Selling Property in the Philippines: What You Need Before You List

Final Thoughts

Selling property in the Philippines doesn’t have to be painful. It can be simple—if you prepare, price wisely, and stay realistic. Talk to people. Ask questions. Keep things organized.

And above all, stay patient. The right buyer will come along.

Whether you’re selling a small lot in the province or a condo in the city, you deserve a smooth, successful sale.

Got questions? Drop them in the comments. And if you’ve sold a place recently, share your story—what worked, what didn’t, what surprised you. Let’s make this process easier for everyone.

Join The Discussion